C’è un particolare curioso relativo all’ultracentenaria storia del calcio: quasi mai lo sport più amato e popolare del mondo è riuscito a prestarsi al cinema. Altri sport sì, a volte anche per qualche capolavoro, come il football americano in Quella sporca ultima meta, l’hockey sul ghiaccio in Miracle e, naturalmente, la boxe in Rocky o Toro scatenato. Ma il calcio no. Forse perché portare sullo schermo le azioni veloci o le giocate di un fuoriclasse non è la stessa cosa che vederle dal vivo, con tutte le emozioni provate sul momento difficilmente ricreabili nonostante la loro bellezza. The english game, però, questo problema non se lo è posto. Anzi, la miniserie tv Netflix ha avuto forse un doppio merito: arrivare nel momento in cui il calcio, bloccato dal coronavirus, aveva bisogno di fare realmente i conti con sé stesso e, nondimeno, aver proposto agli spettatori una parte della storia che ben pochi conoscono. La nascita del calcio vero, quello moderno, quello di oggi.

La nascita del professionismo

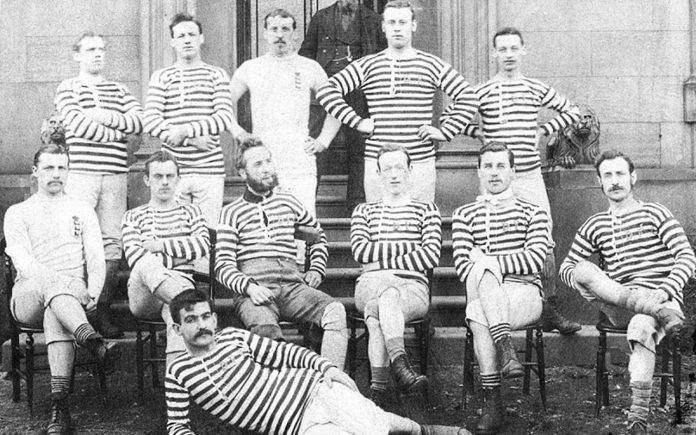

Inghilterra, fine Ottocento. Darwen è una città industriale, come tante altre nel Lancashire, dove James Walsh, proprietario di un locale mulino e responsabile dei destini di molti operai, chiama da Glasgow due calciatori scozzesi destinati a rivoluzionare il calcio vittoriano. Fergus Suter e Jimmy Love approdano al Darwen Fc, gestito proprio da Walsh, che investe per la prima volta in assoluto del denaro per ingaggiare dei giocatori. Sì, la prima operazione di mercato della storia, vietata da un regolamento che, nel 1879, è ancora quello stilato dalla giovane Football Association, fondata e gestita dai gentleman dell’alta società britannica, per i quali il calcio è un gioco sul serio. Regole che, allora, non tengono conto della reale crescita di uno sport che, da passatempo signorile, ha iniziato a spopolare anche nella classe operaia, stimolando la nascita di sempre nuove società. Il primo a intuire che il vento stia cambiando è sir Arthur Kinnaird, giovane lord di larghe vedute, cosa rara per l’opulenta classe signorile dell’Inghilterra vittoriana, e attaccante dell’Old Etonians, campione in carica delle FA Cup, il torneo calcistico più importante del Regno Unito. Per alcuni, l’occasione della vita.

La forza del gioco

Trama finita. Anche perché, in sole sei puntate, dilungarsi troppo avrebbe probabilmente fatto perdere consistenza alla serie piuttosto che consolidarla. La forza di The english game non è tanto la storia, piuttosto conosciuta per gli appassionati del football di fine Ottocento, quanto la capacità di utilizzare il calcio come veicolo di comprensione di un’epoca di cambiamento radicale, la cui portata storica sfuggiva a un’alta borghesia assuefatta dal mito dell’Impero britannico. Il calcio di quegli anni, giocato in campi d’erba rase, senza reti né sponsor, assumeva davvero una connotazione ben al di sopra della semplice lettura sportiva: il Darwen, composto da operai come le altre società proletarie dell’epoca (composte da uomini che accorpavano gli allenamenti alle ore di lavoro in fabbrica), vedeva nel calcio una possibilità di emancipazione sociale, in un periodo in cui la crisi economica rallentava le paghe ma non il lavoro delle industrie tessili, portando sempre più spesso le folle in strada.

Suter e Love, pagati per giocare a calcio, rivoluzionano i dettami tecnici degli albori del pallone, apportando quelle innovazioni tattiche che imporranno, di lì a qualche anno, un necessario rinnovamento del gioco, aprendo di fatto la via della modernità. E, per la prima volta, alla reale possibilità di confrontarsi alla pari con coloro che il destino aveva voluto superiori di rango. Emblematico in questo senso l’episodio (reale) del 5-5 ai quarti della FA Cup del 1879, fra Darwen e Old Etonians, con i nobili categorici nel non voler giocare i supplementari, costringendo gli operai a ripresentarsi (carico di lavoro annesso) per ben due ripetizioni.

Vento di cambiamento

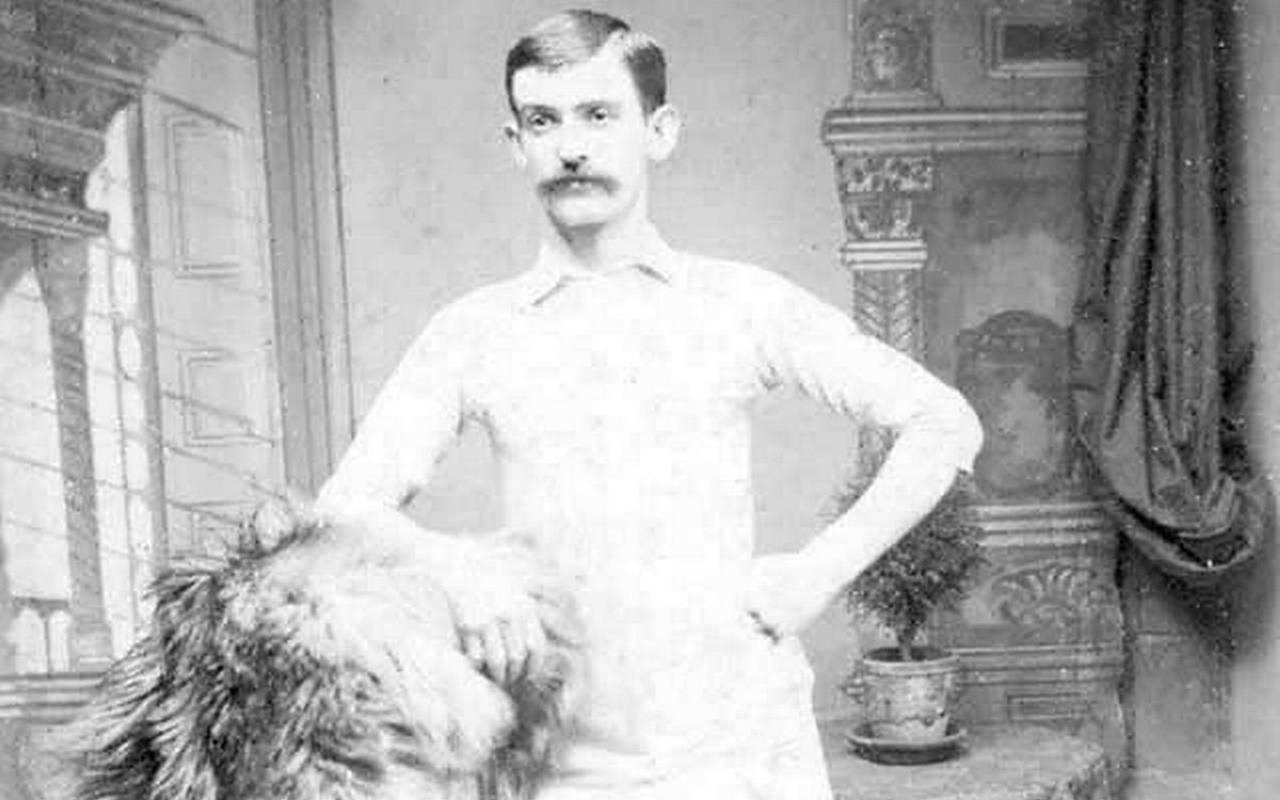

Sport e retaggi sociali vanno di pari passo. E il pallone finisce per rotolare nella direzione giusta, nonostante la strenua opposizione al cambiamento di una borghesia che continua a guardare al calcio come a una distrazione da nobili piuttosto che a una possibile nuova industria. Lord Kinnaird, leone in campo (tanto da essere considerato, storicamente, il primo vero campione della storia del calcio) e lungimirante ma accorto uomo di mondo, lo intuisce prima degli altri, imprimendo la prima svolta in termini burocratici a uno sport che cambiava velocemente nello stesso modo in cui, quasi senza accorgersene, stava cambiando la società britannica. A Suter del resto (tri-campione in FA Cup ma con la maglia del Blackburn), il merito di portare il l’aria nuova sul campo da gioco e (nella fiction) nell’animo di una classe operaia che, pur costretta a contrattare passivamente sul ribasso dei salari e a fare i conti con l’impossibilità (letterale) di far mangiare i propri figli, andava via via rivendicando in modo sempre più netto il suo ruolo di vera forza di maggioranza del Paese.

The english game ha il merito di realizzare tutto in poco spazio, marcando in modo netto gli abissi sociali fra alta borghesia e proletariato, ma anche i guadi sempre più numerosi che produceva la fragilità, sempre più evidente, del mito britannico. Licenze poetiche? Diverse ma roba da puristi. D’altronde è il messaggio quello che conta. E quello arriva forte e chiaro.